The layout of NIO ’s desperate “investment” in power swap stations was ridiculed as a “money-throwing deal”, but the “Notice on Improving the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles” was jointly issued by the four ministries and commissions to strengthen the construction of power swap stations. After the subsidy for replacing the battery model , everything becomes different. With the support of the state, the power exchange industry is now different from what it used to be. Not only Weilai, but also many companies such as GAC Aian, Ningde Times , Tesla , and Volkswagen have invested in the power exchange industry. Therefore, one stone stirred up a thousand waves, and the power exchange mode quickly sparked discussions in the industry. Even the friends of the “EMF” fan group couldn’t sit still and asked, “Is the power exchange mode feasible?”

1、

Relentless exploration.

In fact, the exploration of the power exchange mode has been started in China more than 20 years ago. In 2000, Dianba New Energy was established. The development laid the foundation. From 2010 to 2015, State Grid and Xuji Electric entered the field of power exchange, but it backfired, and their investment did not achieve good results.

The power exchange model has really ushered in a turning point in development. In fact, in 2016, the cooperation between BAIC New Energy and Aodong New Energy launched the “Ten Cities and Thousand Stations Optimus Prime Plan”, and the passenger car power exchange model was launched for the electric taxi market. . Then, domestic mainstream car companies such as Weilai, GAC Aian, FAW Hongqi, and Geely have added “power battery chassis power exchange technology” to some models, which has promoted the development of the power exchange mode.

Especially this year, it has ushered in the “first year of battery replacement”, and many companies have released their own transcripts in the field of battery replacement.

On January 18, the power battery giant CATL launched EVOGO, a battery swap service brand. On June 18, CATL launched the EVOGO battery swap service in Hefei, Anhui.

On January 24, Lifan Technology and Geely Automobile jointly established a joint venture company, Ruilan Automobile, which entered the new energy vehicle market with the “new power of battery swapping” and developed new products based on the self-developed battery swapping platform (GBRC battery swapping). platform) covering sedans, SUVs , MPVs and even logistics vehicles and other models, and exerting efforts in the B-end car-hailing and the C-end individual users’ power exchange needs at the same time. On April 27, CATL and AIWAYS signed the EVOGO battery swap project cooperation framework agreement. According to the agreement, both parties will use AIWAYS U5 as a carrier to jointly develop a combined battery swap version, which is planned to be introduced to the market in the fourth quarter of this year. , Aiways owners who choose the combined battery swap version can enjoy the EVOGO battery swap service that separates vehicle power, distributes electricity on demand, and can be charged and replaced.

On May 6, Changan Deep Blue announced the configuration information of its sedan C385, which can support a variety of power sources including battery swapping modes. The new car will be officially launched in August. On June 2, the first batch of battery-swapped taxis (Nezha U Pro) that landed in Nanning, Guangxi was officially delivered . Hezhong , Chery and other 16 OEMs have reached a development cooperation of 30+ battery swap models) Driven by the shared battery swap service network built in Nanning and the battery swap policy, Hozon Nezha joins hands with Aodong New Energy and Northern Taxi The company and other enterprises promote the application and development of power exchange dynamics in the Nanning market. On June 13, MG MULAN officially released a new technical highlight, and the SAIC “Magic Cube” battery that can support power exchange was decrypted for the first time. On July 6, NIO said that the total number of battery swap stations in the country has reached 1,011. Ruilan Automobile will expand to all parts of the country with “Chongqing” as its construction camp. It plans to build more than 5,000 battery swap stations in 2025, covering 100. above cities.

The frequent actions of new energy vehicle brands such as SAIC, Changan, and Nezha in the battery swap market are all based on the two-wheel drive of users’ needs and policies.

It is understood that the penetration rate of new energy vehicles is expected to exceed 30% in 2025, which greatly increases users’ demand for energy supplementation. In addition, in 2020, charging facilities will be included in seven new infrastructure areas; since 2021, relevant policies have been continuously introduced, and the government work report clearly proposes to increase the construction of facilities such as charging piles and swap stations.

2、

The advantages and disadvantages of battery swapping.

At present, the supplementary energy of electric vehicles relies on two methods: battery swapping and charging, but such topics as “will battery swapping replace charging?” and “is the battery swapping mode better or the charging mode better?” , some car companies and even industry experts believe that they are in a competitive relationship.

Previously, Tong Zongqi, director of the Information Department of the China Electric Vehicle Charging Infrastructure Promotion Alliance, said, “Currently, the battery replacement mode is mainly concentrated in the field of operation and heavy trucks. New energy vehicles in the private sector are still dominated by slow charging, supplemented by fast charging, and battery replacement. It’s not going to be mainstream as a supplement.”

Some experts also said that fast charging has great damage to the power battery and has a great impact on the power grid. Especially when a large number of electric vehicles use fast charging at the same time, the local power grid will be under great pressure, and battery replacement will have a great impact on the battery. The damage is relatively small, and peak and valley electricity can also be used, which can improve energy utilization.

Li Shufu, chairman of Geely Holding Group, a representative of the National People’s Congress, proposed to increase the construction of the power exchange system at the two sessions this year. He believes that the power exchange mode of separation of vehicle and electricity has two advantages over the charging mode, which are efficient energy replenishment and cost reduction.

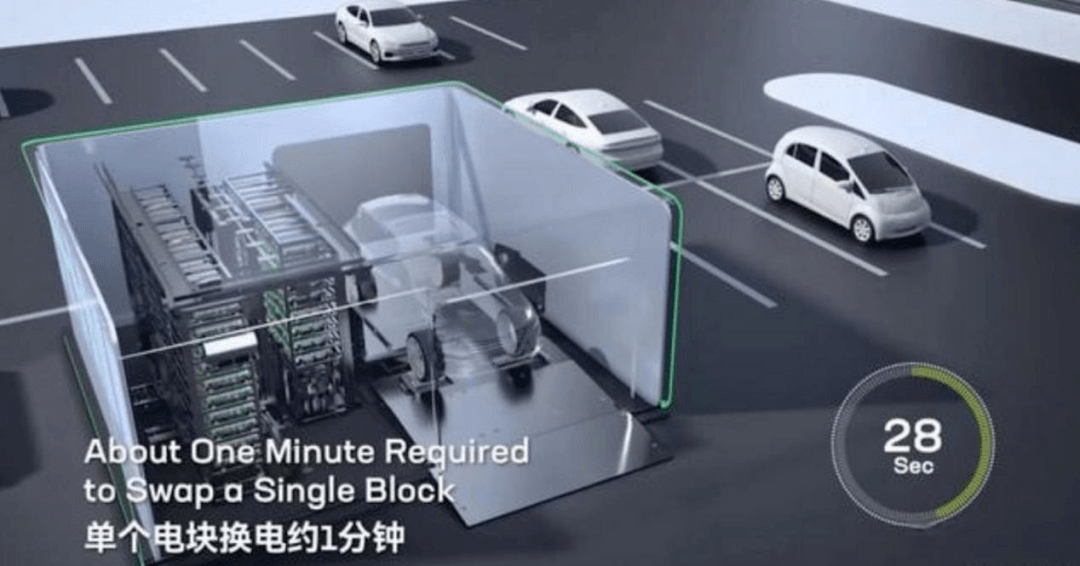

In terms of high-efficiency energy supplementation, when the electric vehicles on the market use the fast charging mode, most of the electric vehicles can be charged from 30% to 80% in about 30 minutes (actually generally more than 30 minutes), and it only takes 1 -5 minutes or so. It is reported that Aodong New Energy’s latest fourth-generation power exchange station has achieved the whole process of 1 minute, and the power exchange process only takes 20S, which is comparable to that of a gas station.

In terms of cost, power batteries account for about 40% of the entire vehicle. The “vehicle-electrical integration” charging mode greatly increases the cost of the entire vehicle. In the vehicle-electricity separation mode, the purchase price of an electric vehicle can be reduced by up to half. Therefore, the battery swap mode not only shortens the charging time, but also relieves the pressure on the power grid, and can also reduce the price, which has naturally become the focus of enterprises.

In essence, the battery replacement mode is very simple, that is, the chassis or lateral power battery pack used in the new energy vehicle is adapted to the battery replacement technology, and the battery pack is removed and replaced at the replacement station to achieve the purpose of energy supplementation.

The reason why many companies pay attention to the battery replacement mode is that it is suitable for “rechargeable, replaceable, and upgradeable” in different scenarios, and has the characteristics of diversification, efficiency, convenience, and safety. In addition to the high-efficiency supplementation mentioned above, its advantages include the following four points:

1. Extend battery life. The battery in the battery swap mode is charged at a uniform speed and concentrated in the constant temperature and humidity charging compartment, which protects the SOH (health) and SOC (cruising range) in the battery. Even if it is cold, it can quickly provide a full charge to the vehicle. Battery, don’t worry about not charging.

2. Improve battery safety. In the battery swap mode, the background of the swap station will analyze the battery status in time and eliminate battery faults and other safety management, thereby reducing vehicle combustion and safety losses caused by thermal runaway of the power battery.

3. Lower the threshold for purchasing a car. Compared with the “vehicle-electricity integration” charging mode, the “vehicle-electricity separation” power exchange mode is suitable for leasing different specifications of power batteries in different travel scenarios, which can not only reduce the user’s purchase cost, but also realize long-lasting car usage scenarios. .

4. Conducive to recycling. For example, the cascade utilization of lithium batteries can effectively improve the comprehensive economic effect of the whole society.

Of course, there are pros and cons to swapping. Battery swapping is a heavy asset industry, which has a relatively large cost burden on investors and a long payback period. Frequent plugging and unplugging of power batteries is dangerous. At the same time, some experts have indicated that the ratio of swapped vehicles to reserve batteries should be 1:1.3 to be reasonable, but this is not the case.

Taking NIO as an example, the current ratio of NIO to battery replacement is about 1:1.04. Because the ratio of car purchases and battery replacement is obviously not equal, NIO has been building replacement batteries in the past two years. With efforts in the power station, the Baas car purchase plan launched by Weilai has become a promotion method for new car sales.

On June 28, NIO said that it has provided more than 9.7 million battery swap services at 997 swap stations around the world, and completed 4,795 overcharged piles and 4,391 destination charging piles, but it is still in a state of loss. .

3、

There are many difficulties, and the profit model is the ultimate test.

The reason why some car companies are not optimistic about the battery swap model is that it serves a single target and lacks standards.

Because of the differences in power battery design, materials, technology, etc., the energy density and size of power batteries are not uniform. Therefore, the power exchange station can only serve a single model, which will easily lead to idle power station resources and operational efficiency. Low and other situations, thereby raising the operating cost and application scale of the construction of the power exchange station.

In fact, the fundamental logic of battery swapping lies in the separation of vehicle and electricity, standard batteries, and the realization of an independent closed loop of energy. However, it is really difficult to standardize the battery. There are as many as 145 types of power batteries on the market. The power exchange methods include side power exchange, sub-box power exchange, and chassis power exchange. It is difficult to change new energy for many reasons. Manufacturers have design ideas and standards for power batteries, so if you want to achieve the standard of “universal battery swap”, you need to cross a big gap.

And because of the competitive relationship between new energy vehicle manufacturers, the design of power batteries and the way of power exchange are differentiated, and no one is willing to disclose their own solutions or adopt rival solutions.

At present, many companies are already starting the general design of battery packs, but it will take time to form combat power.

However, the biggest challenge to the power swap mode is not the lack of a unified standard for power batteries, but how to improve the utilization rate of a single station to achieve profitability.

According to the calculation model of CITIC Securities Research Institute, the construction cost of a single station of a passenger car swap station is about 4.9 million yuan, and the construction cost of a single station of a commercial vehicle swap station is about 10 million yuan. The break-even point of the former corresponds to 20% of the utilization rate. A rough calculation is to serve 60 vehicles per day; the break-even point of the latter is 10%, that is, 24 vehicles are served per day. Judging from the number of swap stations at this stage, the break-even point cannot be reached at all.

The data can always reflect the most real situation. Taking the third-party power exchange operator Aodong New Energy as an example, the total revenue from 2018 to 2020 was 82.4749 million yuan, 212 million yuan and 190 million yuan, and the net losses were respectively It is 186 million yuan, 162 million yuan and 249 million yuan, with a cumulative loss of 597 million yuan in three years.

Therefore, in the face of the relatively small online car-hailing market, the layout of battery swap stations is not perfect, and the inconsistency of battery standards affects the interests and development routes of all parties. It is more difficult for the OEMs.

4、

at last:

It is undeniable that, compared to charging, battery swapping has an overwhelming advantage in energy replenishment efficiency.

Not to mention whether the battery swap mode will replace the charging mode in the future, at least from the perspective of many car companies participating in the battery swap mode, the battery swap solution is feasible, more effective battery management, taking into account energy storage, and small impact on the power grid is fast. Charge can’t be done.

From the perspective of the industry, if the standardization and unification of power batteries is realized, it will be possible to achieve unified recycling and unified market services, which will drive the upstream and downstream development of the new energy vehicle industry chain.

Perhaps for a long time in the future, new energy vehicles will still be mainly based on slow charging, supplemented by fast charging and battery swapping. The unified national power battery standard cannot be solved, but we believe that as long as there is demand in the market, the traceability system needs to be further improved. , has an adaptive optimization for the vehicle-electricity separation mode. After the battery-swap mode is recognized, many car companies form a group to achieve 2-3 power battery standards, then the battery-swap mode must have room for survival and development.

Post time: Aug-17-2022