In the past five years, the rapid development of new energy vehicles in my country’s urban bus passenger transport industry has continued to increase the demand for urban buses to replace diesel vehicles, bringing huge market opportunities for buses with zero emissions and suitable for low-to-medium speed operation. However, the new energy buses from 2019 to 2022 did not expand into the market other than buses, and even declined in the non-operating field due to the decline in the cost performance of subsidies . The adaptability of the new energy bus market is under greater pressure.

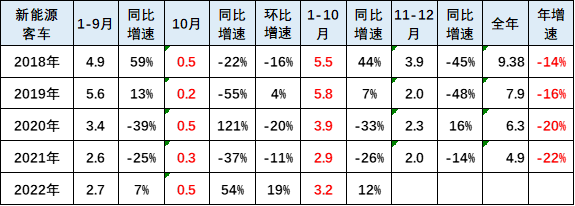

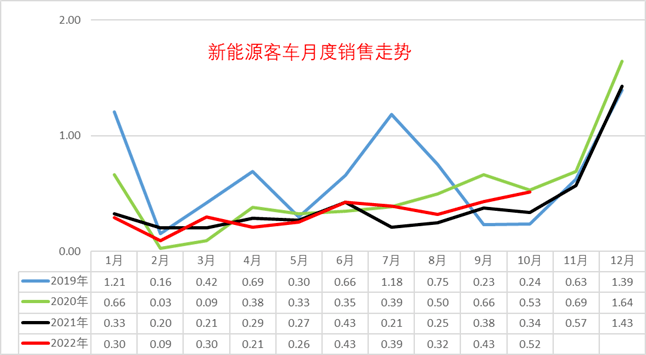

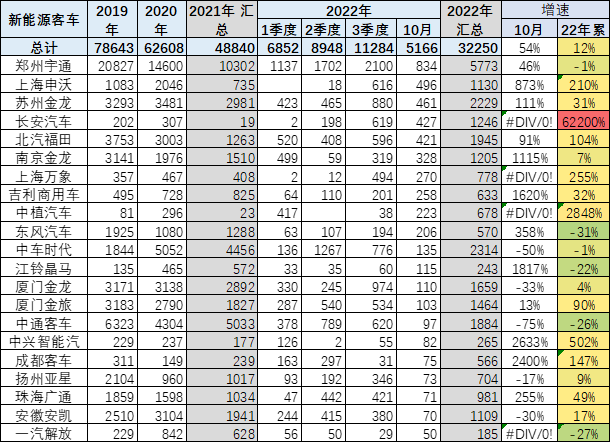

In 2022, new energy vehicles will gradually develop independently from subsidies, but the pressure on the new energy bus market is still high. In October 2022, the sales volume of new energy buses was 5,200 units, a year-on-year growth rate of 54% and a month-on-month increase of 19%. From January to October 2022, the sales volume of new energy buses is 32,000 units, which is a relatively good performance with an increase of 12%. Although the overall trend of the new energy bus market is weak and the epidemic has hit hard, this is also a temporary impact. With the continuous advancement of the blue sky defense war, the development of diesel vehicles is facing a huge crisis. Large and medium-sized buses are the core of new energy urban transportation. New energy buses have great advantages. Urban public transportation is still the core and main market for new energy buses.

1. Performance of new energy buses in 2022

In recent years, the sales of new energy buses have continued to grow slightly negatively, which is also a feature of the small and saturated demand. In October 2022, the sales volume of new energy buses was 5,200 units, a year-on-year growth rate of 54% and a month-on-month increase of 19%. From January to October 2022, the sales volume of new energy buses is 32,000 units, which is a relatively good performance with an increase of 12%.

2. Growth characteristics of passenger cars

In October 2022, the performance of new energy buses was relatively good, and the year-on-year sales trend was basically flat, which was basically the same as in October 2020. This was reflected in the rush to install in the fourth quarter, but the epidemic situation and local lack of money led to insufficient demand.

The licensing trend of new energy buses is relatively complicated, and the overall bus market is saturated, but new energy vehicles are still relatively profitable.

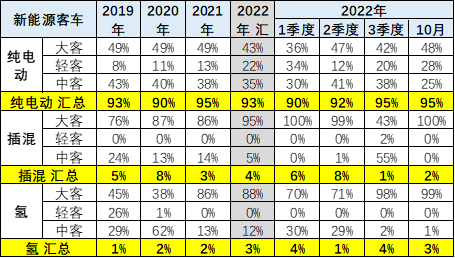

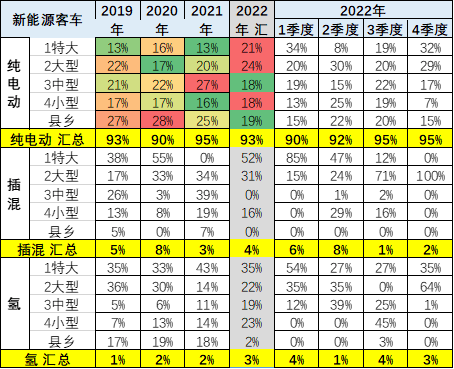

3. Product features of new energy buses

China’s new energy bus products are developing in the direction of pure electric and large-scale. The products of new energy buses have gradually stabilized, large and medium-sized buses have become the main force, and the micro-bus market has gradually become a feature of logistics.

In the analysis, some light buses with prefix 5 were excluded. The main consideration is that because there are many small and light buses in special vehicles, electric micro-buses should actually be the demand for logistics vehicles, not a feature of passenger cars and general buses.

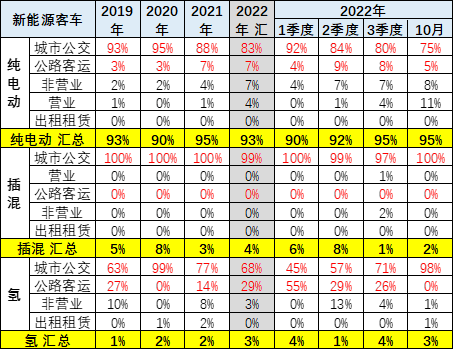

4. Application characteristics of new energy buses

The proportion of new energy buses in urban public transportation is gradually increasing. In 2022, the proportion of public transport in DAC will decrease slightly compared to the same period in 2021, but it will still reach a relatively high level of about 80%.

Large and medium-sized buses are basically used for public transportation. There is no market for new energy large and medium-sized buses for other purposes, or the market is gradually shrinking. This is also a manifestation of the lack of market competitiveness of new energy buses caused by the reduction of huge subsidies.

The market space for plug-in hybrids is very small, basically all of them are buses, and there is no market other than that. However, the recent range-extended electric vehicle market has become active again, which is also worthy of attention.

5. The performance of the regional market is gradually improving

At present, the trend of new energy vehicles replacing traditional vehicles in large and medium-sized cities is obvious. In particular, the sales of passenger cars in cities with purchase restrictions are strong, and the sales volume is the largest in major cities without purchase restrictions, while the demand for traditional vehicles in such large and medium-sized cities is relatively weak.

With the pressure of environmental protection and the promotion of road rights, electric vehicles under 6 meters in the megacity market performed well, especially light passenger electric vehicles with a height of 5.9 meters performed well.

6. Differentiation of New Energy Bus Enterprises in 2022

There are a large number of bus companies, and the participation of major companies is not very strong. However, there have been more light buses installed in Changan recently. The major automakers in October performed very well, with Zhengzhou Yutong, Shanghai Sunwin, Suzhou Jinlong, Changan Automobile, and Beiqi Foton performing relatively well.

The competitive advantages of traditional bus companies cannot be shaken. The “investment for market” of new forces is a shortcut for deep regional penetration, and product performance is the basic skill for foreign brands to expand their markets.

The regional characteristics of new energy buses are still obvious, and major car companies have good local resources, forming a harmonious development situation.

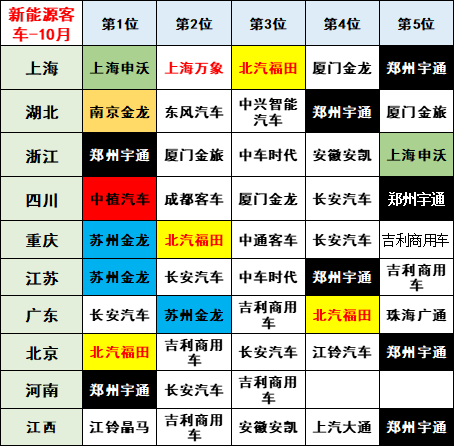

7. In 2022, enterprises in various regional markets will be quite different

In October 2022, Shanghai, Hubei, Zhejiang, Sichuan, Chongqing, Jiangsu, Guangdong, Beijing, etc. will have the strongest performance of new energy buses. Local key enterprises generally perform well in the local area, and basically all local finances have relatively recognized and supported core enterprises.

Due to the increase in the proportion of private car travel after the epidemic, coupled with the increase in the proportion of personal two-wheel travel, the demand for new energy in the bus market is weak, it is relatively difficult for bus companies, and market competition is promoted by multiple factors.

Post time: Nov-23-2022