In August, there were 369,000 pure electric vehicles and 110,000 plug-in hybrids, totaling 479,000. The absolute data is still very good. Looking at the characteristics in depth, there are some characteristics:

● Among the 369,000 pure electric vehicles, SUVs (134,000) , A00 (86,600) and A- segments (74,800) are currently in the forefront . ET5 to come.

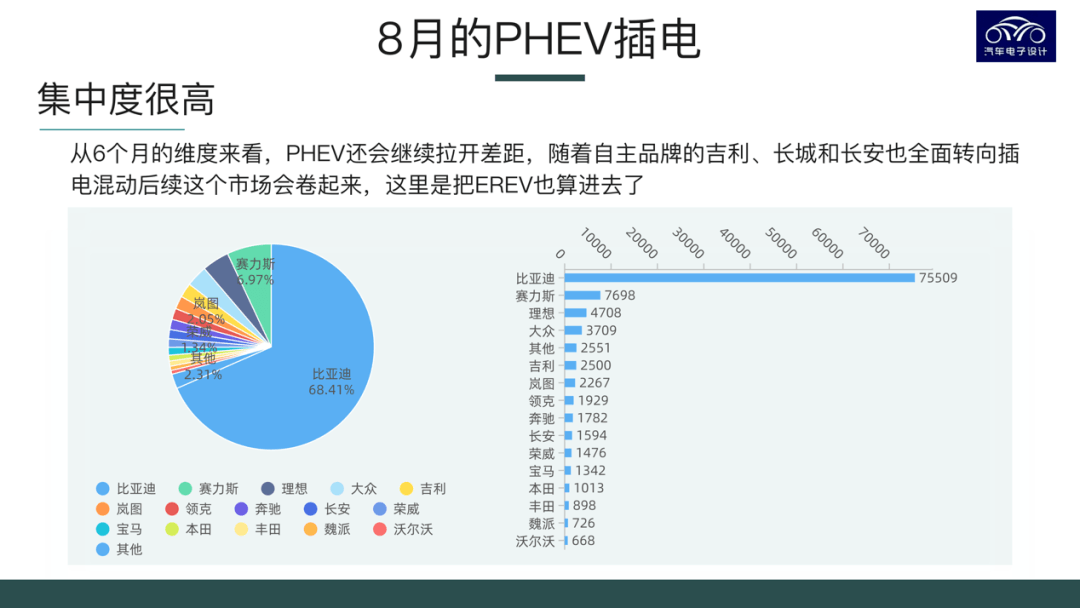

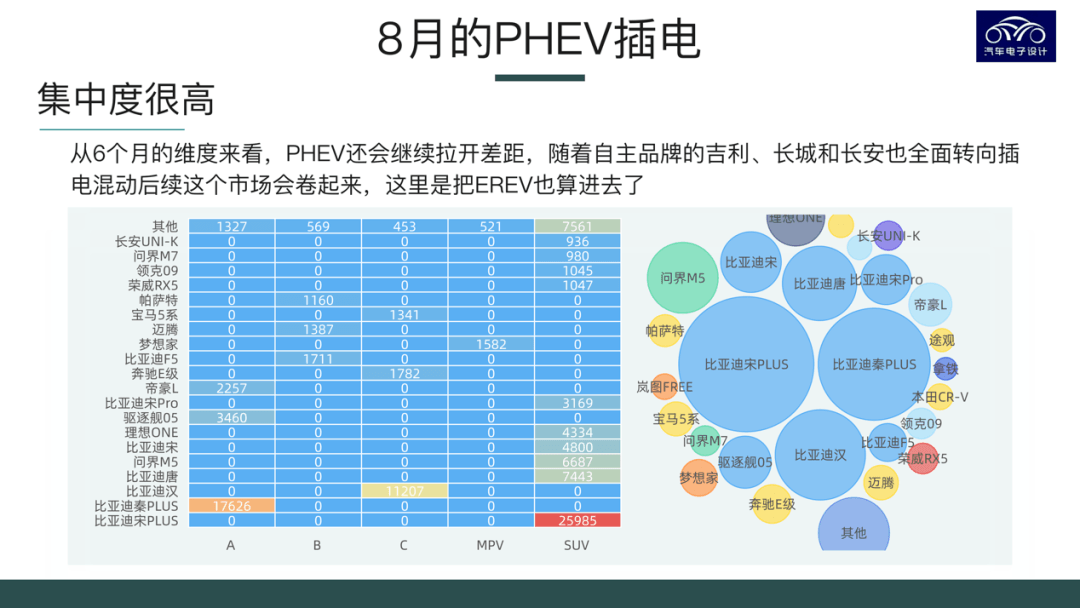

● At present, the concentration of PHEVs is too concentrated in terms of brands, and it is also concentrated in SUVs in terms of classification. With the entry of Haval, Changan, Great Wall and Chery, the performance of this market in 2023 will be more balanced.

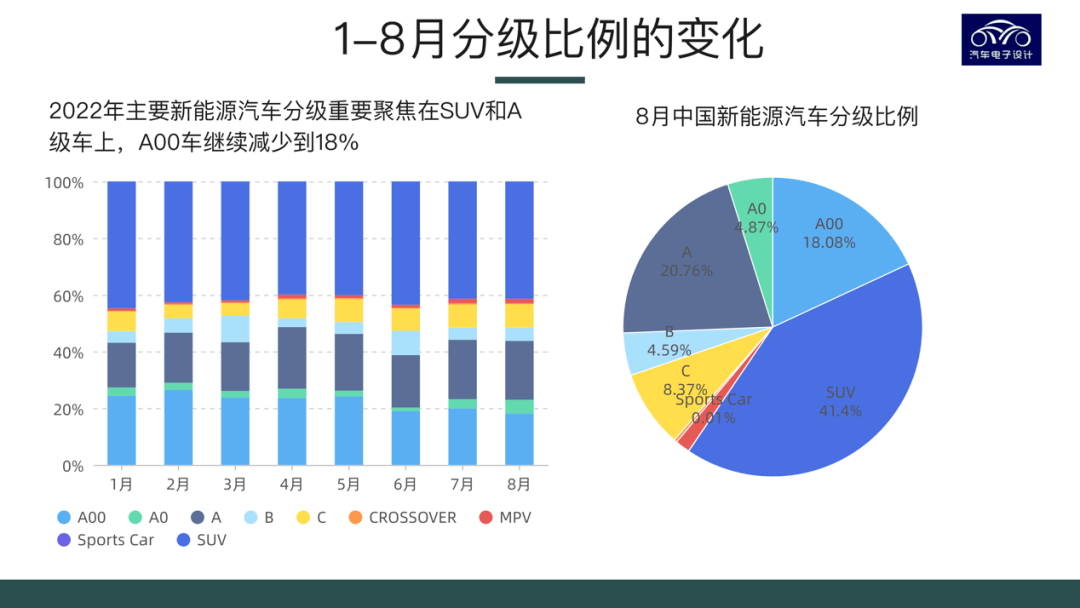

● The A00 level has stably dropped below 20% in the entire system. In the current cost structure, as we said before, it is not bad that the market is stable at 1 million. With the reduction of Chery, only Wuling and Changan will continue.

▲Figure 1. Overall data overview from January to August 2022

Part 1

Plug-in hybrid rivers and lakes

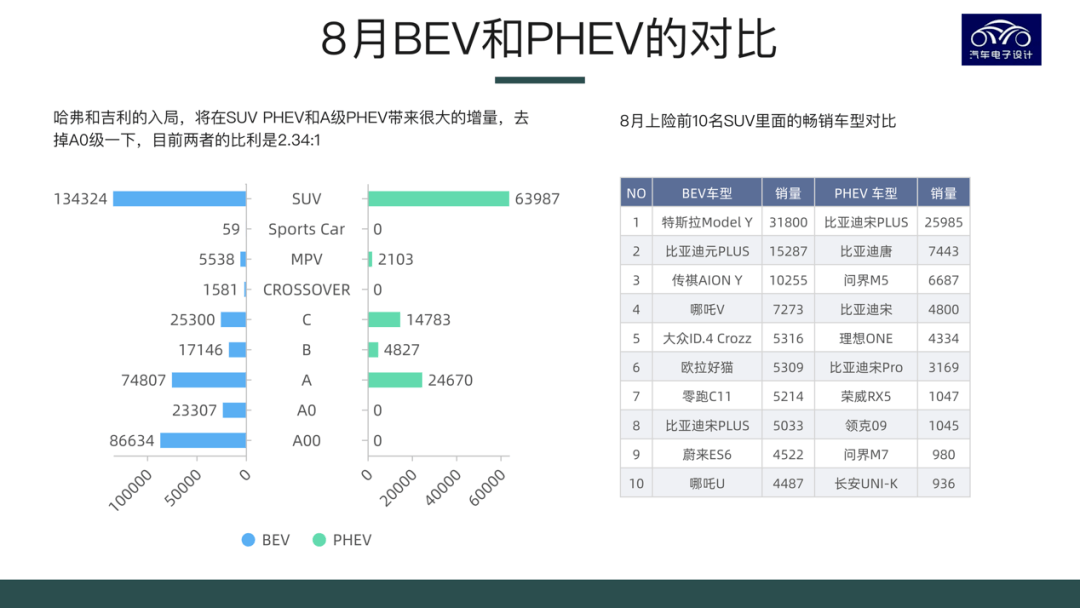

We see that as the cost of batteries does not keep going down, PHEVs/EREVs with different battery capacities will have opportunities. In fact, by 2023, even HEVs will have opportunities. If the cars below A0 are removed, the ratio of pure electric to plug-in hybrid is 2.34:1 in products above A-class, and this data will be adjusted.

● SUV: 134,000 units vs. 64,000 units. If we take it apart, we can see that the current supply of pure electric SUVs is very sufficient, while relatively speaking, plug-in SUVs are just beginning to be popularized in the market. Especially with the following several Changcheng(Haval + WEY), Geely(Emgrand, Changan and Chery, plus the ideals and questions that performed well in this area.

● C-class car: The current ratio here is 25300vs14783, and there are currently no popular models.

● B-class car: With the weakening of the Model 3, the pure electric power will be used to see ET5; there is actually quite a lot of room for plugging in, depending on how each company promotes the product.

● A-class car: 75,000 vs 25,000, don’t worry too much about this, because 2B vehicles are the most, if you simply compare the amount of C-end, maybe A-class plug-in personal use is more.

Therefore, it seems that this year, with the upward momentum of new forces slowing down, the development direction of pure electric is not clear. Most of the models are to replace Model 3 and Model Y, but there is not much new idea to roll around.

▲Figure 2. Comparison of pure electric and plug-in hybrid

The current concentration of plug-in hybrids is quite high. BYD, the champion, accounts for 70% of the total. The second place is the Celis. I think after rolling up, the supply of this piece will be very sufficient.

▲Figure 3. Brand situation of plug-in hybrid

Why? Strictly speaking, there is not much difference between PHEV and crude oil fuel vehicles. Change the powertrain and the achievement is over. Therefore, the investment in this area will basically be able to produce products in 2023. The subsequent investment is nothing more than replacing a certain proportion of your own fuel vehicles, and the growth rate is relatively fast.

▲Figure 4. The graded heat map of the plug-in hybrid and the models in the SUV

Part 2

Inventory of pure electric vehicles

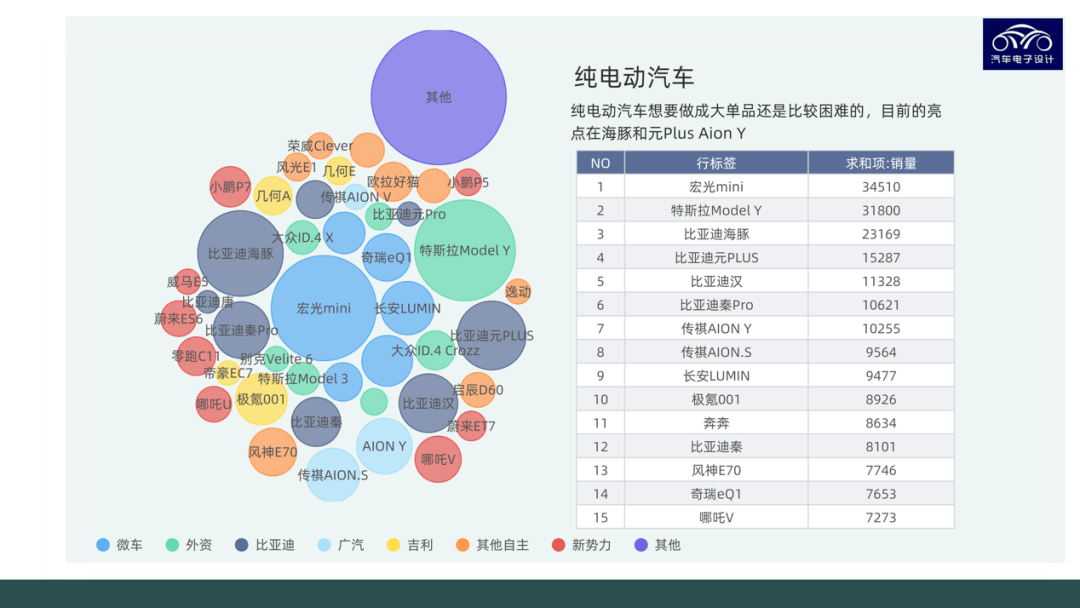

The pure electric models we saw in August are all old-fashioned, dolphins for individual consumers. The sales of 23,000 are very big surprises. With the addition of 15,300 units of Yuan Plus and 10,600 units of Aion Y, these cars are still biased. For household use, the fast growth rate is indeed in the range of 100,000-150,000.

I think from the perspective of the sales growth rate of pure electric vehicles, consumers have begun to pay great attention to cost performance, and the growth rate of new energy vehicles, which are relatively expensive, is not as fast as expected. It can be seen that when consumers choose products, the price of new energy vehicles is an important factor. It is expected that the market in 2023 will be more clearly dominated by prices.

▲Figure 5. Inventory of pure electric models

Summary: Judging from the current situation, when plug-in vehicles are fully supplied, pure electric vehicles will be more volatile. Except for a small number of users who pursue high-end consumption, those who used to choose compact cars and SUVs used to be consumers who bought 130,000 fuel vehicles, but now they are looking for slightly more expensive new energy vehicles. The purchasing constraints of consumers in the Chinese market have not changed.

Post time: Sep-21-2022