Germany: Both supply and demand are affected

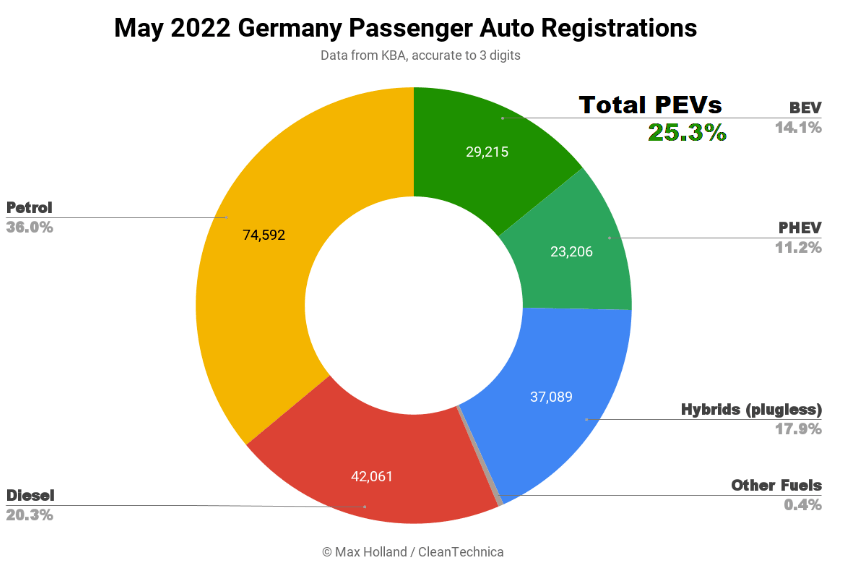

Europe’s largest car market, Germany, sold 52,421 electric vehicles in May 2022, growing from a market share of 23.4% in the same period to 25.3%. The share of pure electric vehicles increased by nearly 25%, while the share of plug-in hybrids fell slightly. Overall vehicle sales were down 10% year over year and 35% below the 2018-2019 seasonal average.

25.3% EV market share in May, including 14.1% BEV (29,215) and 11.2% PHEV (23,206). In the same period 12 months ago, the market share of BEV and PHEV was 11.6% and 11.8% respectively.

In wholesale sales, BEV increased by 9.1% year-on-year, while PHEV decreased by 14.8%. With the broader market down 10.2%, gasoline vehicles took the biggest year-over-year hit, down 15.7%, and their share now stands at 56.4%, compared to 60% a year ago. It can be expected that by the end of the third quarter of 2022, the proportion of gasoline vehicles will drop to nearly 50%.

Recall last month’s report, which noted that German auto production fell 14% in March and capital goods production fell 6.6% overall. With high inflation, automakers have also said they are passing higher costs on to consumers, affecting demand.

Despite severe supply chain disruptions and rising costs, Reinhard Zirpe, president of the German Association of International Automobile Manufacturers (VDIK), claimed that “the backlog of orders is reaching record levels. This shows that customers want to buy cars, but the industry can only deliver to a limited extent.

Due to economic uncertainty, auto demand is unlikely to be the same as it used to be. The best-case scenario for now is that both demand and supply have dropped significantly, but the supply situation is worse, so the waiting list is growing.

So far, KBA has not released figures for the best-selling model.

UK: BMW leads in May

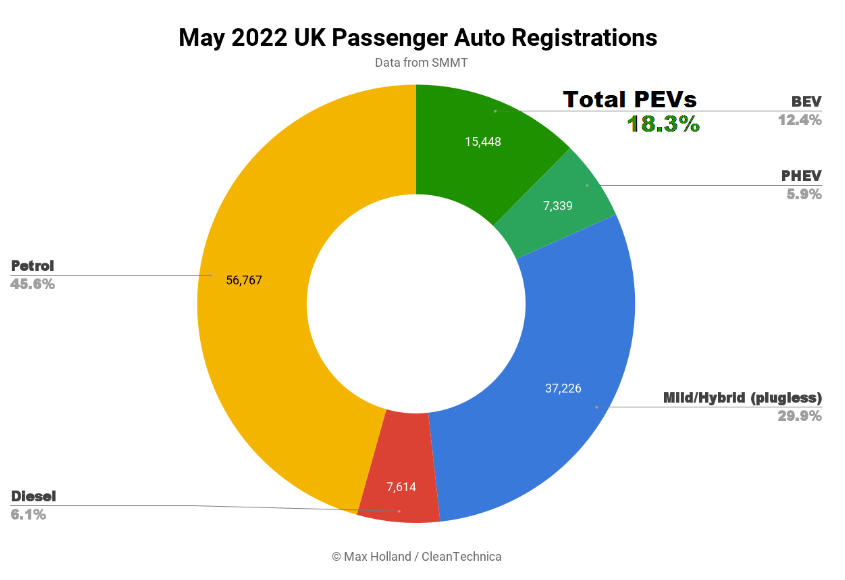

The UK sold 22,787 electric vehicles in May, capturing an 18.3% share of the car market, up 14.7% year-on-year. The share of pure electric vehicles increased by nearly 47.6% year-on-year, while plug-in hybrids lost their share. Overall auto sales were down more than 34% from the pre-pandemic seasonal norm, at 124,394.

18.3% EV share in May, including 12.4% BEV (15,448) and 5.9% PHEV (7,339). With shares of 8.4% and 6.3%, respectively, in the same period last year, BEV grew strongly again, while PHEV was largely flat.

With the UK’s long-time favourite BEV brand Tesla temporarily hampered, other brands have a chance to shine in May. BMW leads, with Kia and Volkswagen in second and third.

MG ranked 8th, accounting for 5.4% of BEV. In the first quarter ended May, MG’s sales rose about 2.3 times, accounting for 5.1% of the BEV market.

France: Fiat 500 leads

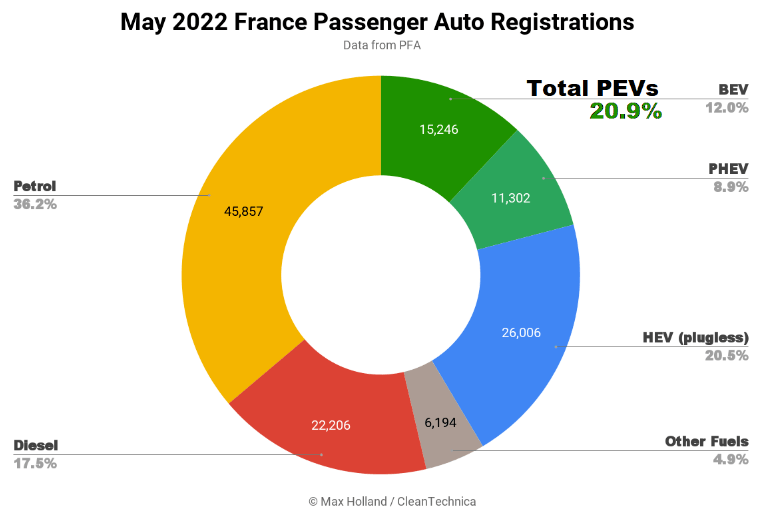

France, Europe’s second-biggest car market, sold 26,548 electric vehicles in April, up 20.9 percent from 17.3 percent a year earlier. The share of pure electric vehicles increased by 46.3% year-on-year to 12%. Overall car sales fell 10% year-on-year and were down about a third from May 2019 to 126,811 units.

Various crises in Europe are having an impact on supply chains, industrial costs, price inflation and public sentiment, so it’s no surprise that the overall auto market is down year-on-year.

The 20.9% share in May included 12.0% BEVs (15,246 units) and 8.9% PHEVs (11,302 units). In May 2021, their respective shares were 8.2% and 9.1%, respectively. So while BEV share is growing at a decent rate, PHEVs have continued to remain roughly flat in recent months.

HEV vehicles sold 26,006 units in May with a share of 20.5% (16.6% y-o-y), while pure fuel vehicles alone continue to lose share, with gasoline and diesel vehicles combined to fall below 50% later this year.

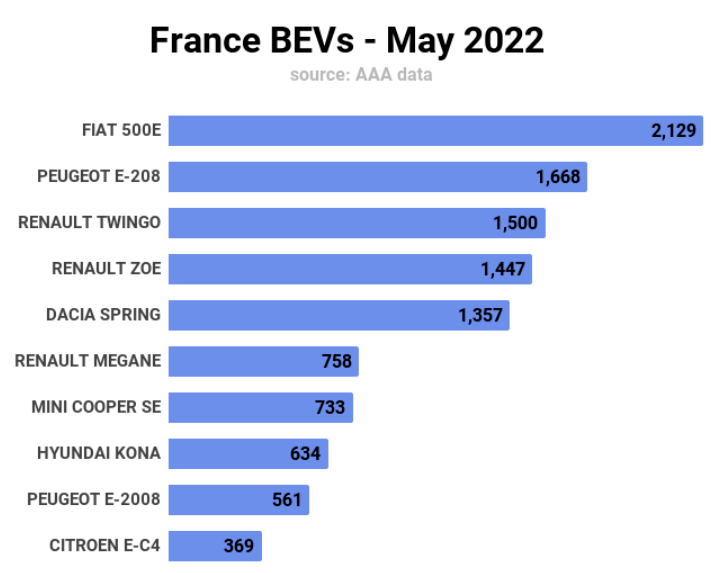

The Fiat 500e topped the BEV rankings in May with its best-ever monthly result (2,129 units), about 20 percent ahead of its last best result in April.

The other faces are mostly familiar, save for the (temporary) slump of Tesla models. The Renault Megane had its first good month with 758 sales, at least 50 percent above its previous best. Now that the Renault Megane is ramping up production, it can be expected to be a common face in the top 10 in the coming months. Deliveries of the Mini Cooper SE were the highest in the last year and about 50% above the previous best (though still below the December peak).

Norway: MG, BYD and SAIC Maxus all entered the top 20

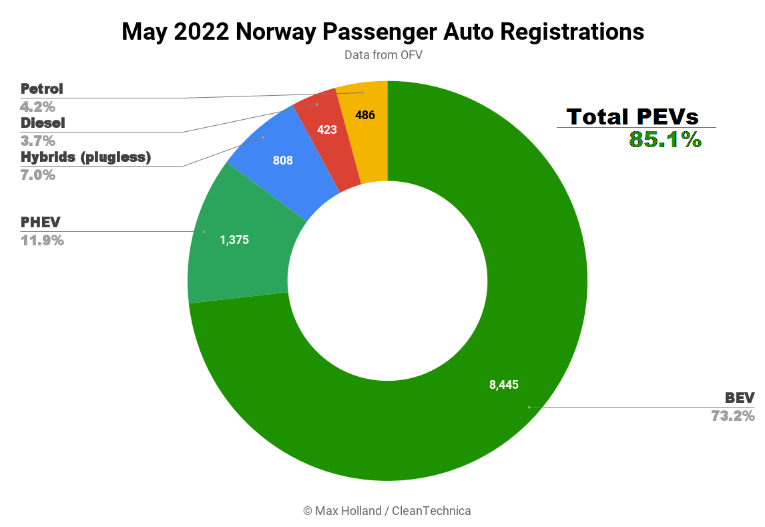

Norway, the European leader in e-mobility, had an electric vehicle share of 85.1% in May 2022, up from 83.3% a year earlier. The 84.2% share in May included 73.2% BEVs (8,445 units) and 11.9% PHEVs (1,375 units). Overall vehicle sales fell 18% year over year to 11,537 units.

Compared to May 2021, the overall auto market is down 18% year-on-year, BEV sales are relatively flat, and PHEVs are down nearly 60% year-on-year. HEV sales fell about 27% year over year.

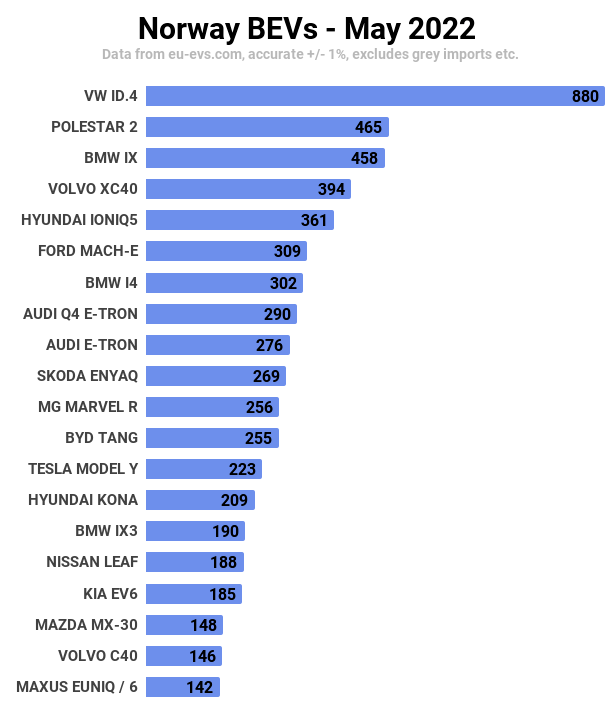

In May, the Volkswagen ID.4 was the best seller in Norway, the Polestar 2 was No. 2 and the BMW iX was No. 3.

Other notable performances include the BMW i4 in seventh place, with monthly sales double the previous best (March) at 302 units. The MG Marvel R came in at No. 11, with sales 2.5 times higher than its previous high (back in November) at 256 units. Likewise, the BYD Tang, in 12th place, had its best performance so far this year with 255 units. SAIC Maxus Euniq 6 also entered the top 20 with monthly sales of 142 units.

By the end of the third quarter, Tesla’s sales should be back on trend and the king will be back. By the end of the fourth quarter, Tesla’s European Gigafactory output could see a noticeable change.

Sweden: MG Marvel R carries quickly

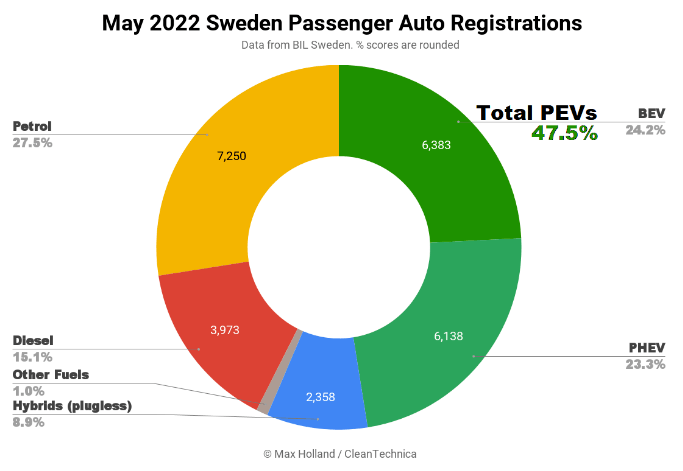

Sweden sold 12,521 EVs in May, capturing a 47.5% market share, up from 39.0% in the same period. The overall auto market sold 26,375 units, up 9% year over year, but still down 9% seasonally.

Last month’s 47.5% EV share included 24.2% BEVs (6,383) and 23.4% PHEVs (6,138), up from 22.2% and 20.8% in the same period.

Fuel-only cars in Sweden have become more expensive (through higher car taxes) since June 1, and thus saw a slight boost in May’s pull sales. The share of diesel vehicles increased slightly year-on-year, from 14.9% to 15.1%, and gasoline also surpassed recent trends. Over the next few months, especially in June, there will be a corresponding drop in these powertrains.

Tesla’s Shanghai plant, a large factory supplying BEVs to Europe, suspended deliveries to European vehicles for much of March, April and May, affecting deliveries, and won’t return until at least June-July, So the region’s EV share may not return to the 60% it reached last December until August or September.

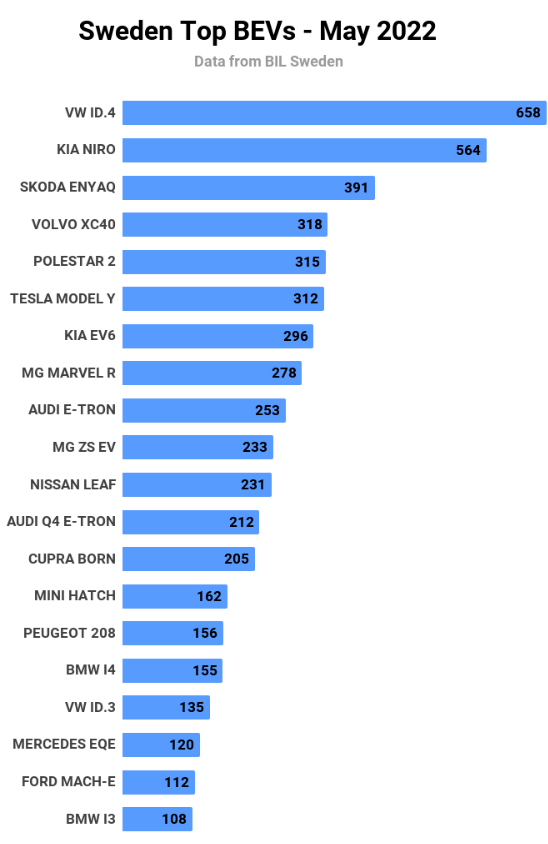

The Volkswagen ID.4 was the best-selling BEV in May, with the Kia Niro second and the Skoda Enyaq third. Sweden’s native Volvo XC40 and Polestar 2 ranked fourth and fifth respectively.

Other notable, MG Marvel R, with 278 monthly sales achieved the highest ever ranking, No. 8. MG ZS EV ranked 10th. Likewise, Cupra Born at No. 13, and BMW i4 at No. 16 both earned their best rankings to date.

The Hyundai Ioniq 5, previously ranked 9th, has dropped to 36th, while its sibling, the Kia EV6, has climbed from 10th to 7th, clearly a strategic decision by the Hyundai Motor Group.

Post time: Jun-10-2022