US President Joe Biden recently attended the North American International Auto Show in Detroit. Biden, who calls himself “Automobile”, tweeted, “Today I visited the Detroit Auto Show and saw electric vehicles with my own eyes, and these electric vehicles give me many reasons to be optimistic about our future.” But embarrassingly, Biden I took a photo of myself and the fuel car – the vehicle is the 2023 Chevrolet Corvette (parameters | inquiry) Z06.

Although this has attracted ridicule from netizens and the Republican Party, it has to be said that since Biden took office, the US support policies related to new energy vehicles have been constantly innovating. Biden pledged at the Detroit Auto Show to provide tens of billions of dollars in loans, manufacturing and consumer tax breaks and grants to accelerate the transition from internal combustion engine vehicles to clean electric vehicles.

At the same time, he also highlighted some recent legislative achievements, one of which is the Inflation Reduction Act, which mentions that the United States will not provide subsidies for new energy vehicles for battery packs and raw materials used in sensitive countries.

In fact, Biden pointed the finger at power batteries last year: “China manufactures 80% of the world’s power batteries. They are not only made in China, but also made in Germany and Mexico, and then exported to the world.” Seeing that China is in the battery industry With the rise of the chain, Biden firmly established FLAG, “China can’t win! Because we won’t let them win.”

Under the Biden administration, the US electric vehicle market is expected to be opened as successfully as China and Europe. At the same time, the United States, which wants to have “less ties” with China, insists on controlling the entire new energy vehicle industry chain.

■ Can the electric vehicle industry really “decouple”?

Biden recently signed into effect the “Inflation Reduction Act”, which has the greatest impact on Chinese companies by setting power battery restrictions on subsidies for clean energy vehicles, which is also regarded by the industry as a “decoupling” of the U.S. electric vehicle industry.

The bill proposes to continue to provide a $7,500 tax credit for new cars, remove the 200,000-vehicle subsidy cap for car companies, but add a “Made in America” requirement. That is, vehicles must be assembled in the United States, a large proportion of power battery components are produced in North America, and a large proportion of key mineral raw materials are produced in the United States or by U.S. free trade partners, and power battery components and key mineral raw materials must not come from foreign sensitive entities.

Carla Bailo, president of the Center for Automotive Research (CAR), said of the goals in the bill: “To the extent that we lack materials right now, I don’t think there is any product today that meets that standard.”

This is not true. Due to the limitations of its own resources and environmental protection, the development and processing of battery raw materials in the United States has been relatively slow.

Among the raw materials for power batteries, the most important ones are nickel, cobalt, and lithium. Global lithium resources are mainly distributed in the “lithium triangle” of South America, namely Argentina, Chile and Bolivia; nickel resources are mainly concentrated in Indonesia and the Philippines; cobalt resources are mostly distributed in countries such as the Congo (DRC) in Africa. The power battery processing industry chain is concentrated in China, Japan and South Korea.

”The bill will prompt new energy vehicle companies to look for more opportunities to source materials from the United States or countries that have free trade agreements with the United States, thereby affecting the global battery material supply chain. The transfer of the supply chain may increase the cost of battery materials.” Fitch Ratings North America Stephen Brown, senior director of corporate ratings, commented.

John Bozzella, president of the American Automobile Innovation Alliance, said frankly that about 70% of the 72 electric vehicles and plug-in hybrids currently on the U.S. market will no longer be eligible. After January 1, 2023, the minimum proportion of 40% of raw materials and 50% of battery components will be implemented, and no model will be eligible for full subsidies. This will affect the U.S. goal of reaching 40%-50% of electric vehicle sales by 2030.

Li Qian, secretary of BYD’s board of directors, also responded to the “decoupling” of electric vehicles in the United States. He said in the WeChat circle of friends: I don’t see it, how can the electric vehicle industry be decoupled? In the electric vehicle industry, the United States is still in its infancy and relies on increasing subsidies to support it, while China has completely shifted from policy-driven to market-driven.

In fact, there are already countries that have taken action ahead of us and are arguing against the United States. According to South Korean media reports, after the United States just released the “Inflation Reduction Act”, the South Korean government did not approve the South Korean L&F company, which produces electric vehicle battery materials, to build a factory in the United States.

The reason given by the Korean Ministry of Industry is that the materials, processes and production technologies related to rechargeable batteries are the most cutting-edge technologies that determine the basis for the competitiveness of the battery industry. If these technologies flow overseas, it will have a negative impact on South Korean industry and national security.

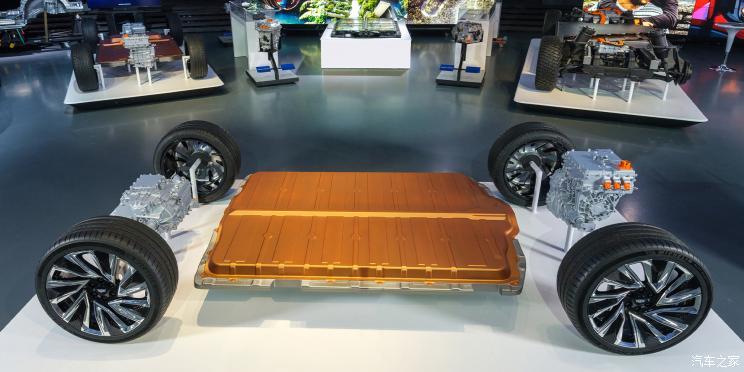

From a practical point of view, even if Chinese batteries are not used, the United States will still have to rely on Korean battery suppliers in the short term. Among them, Ford and SKI are deeply bound and plan to build three super factories with a total of 130GWh; GM will build a joint venture with LG New Energy. ; Stellantis, LG New Energy and Samsung SDI have layout power batteries.

“Universal electric vehicle platform adopts LG new energy battery”

Although the new energy vehicle-related policies in the “Inflation Reduction Law” are less powerful than market expectations, the policy does not set an upper limit on the scale of subsidies and clearly covers the next ten years, with a particularly long time span.

However, the Auto Innovation Alliance, a major U.S. car company alliance, believes that according to the bill, if American car companies want to obtain partial subsidies, it will take at least four years to adjust the supply chain. If they want to fully meet the two constraints of raw materials and component manufacturing, To be fully subsidized, you will have to wait until at least 2027 or 2028.

It is worth mentioning that at present, Tesla and GM have no longer enjoyed the subsidy of 7,500 yuan per bicycle at all, but they can also benefit if they meet the subsidy requirements later. Tesla has announced it is halting plans to manufacture batteries in Germany in order to qualify for the U.S. battery manufacturing tax credit. Currently, they are discussing shipping the manufacturing equipment to the United States.

■ Do Chinese companies suffer big losses?

Tesla, once a leader, is no longer the world’s largest electric car maker. In the first half of this year, BYD sold 640,000 electric vehicles, while Tesla, which had previously been the first, sold only 564,000, ranking second.

In fact, Musk has ridiculed BYD many times, and even directly sprayed in the interview, “BYD is a company without technology, and the price of the car is too high for the product.” But this did not prevent Tesla and BYD from becoming friends. . Blade batteries supplied by BYD have been delivered to Tesla’s Gigafactory in Berlin, Germany, according to multiple people familiar with the matter.

It can be seen that there is no absolute position, only eternal interests, and the new energy of China and the United States has long been integrated.

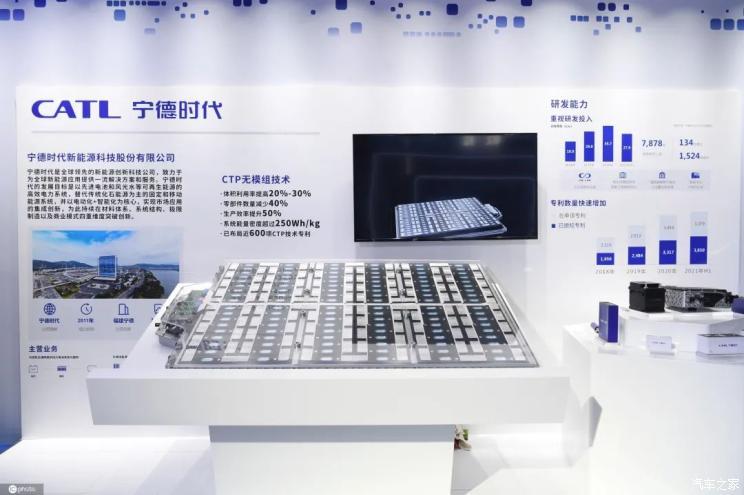

After years of rapid development, China’s new energy vehicle market has formed the most complete industrial chain cluster in the world. In order to strengthen the right to speak in the industrial chain, battery manufacturers represented by CATL will also try their best to extend their tentacles to the upstream industrial chain. Many Chinese companies also participate in the development of overseas mines through equity participation, underwriting, and self-ownership. Ganfeng Lithium and Tianqi Lithium is an enterprise that develops more overseas lithium mines.

It can be said that in the global power battery TOP10, 6 Chinese companies, 3 Korean companies, and 1 Japanese company have become the norm. According to the latest SNE Research data, six Chinese companies have a total market share of 56%, of which CATL has increased its market share from 28% to 34%.

Compared with other countries, China’s electric vehicle industry chain has completed a comprehensive breakthrough from top to bottom-upstream mineral resources staking the ground, midstream power batteries gain a firm foothold, and downstream auto brands blossom everywhere.

And Biden is determined to “hardly decouple” from the global “battery.” CATL has decided to delay announcing a North American factory due to tensions over the U.S. House speaker, according to people familiar with the matter. It is reported that the factory originally planned to invest billions of dollars to supply Tesla and Ford vehicles.

Previously, Zeng Yuqun, chairman of CATL, also made it clear: “We must go to the US market!” But now CATL has invested 7.34 billion euros in the Hungarian market.

Perhaps, more and more companies will suspend their plans to enter the US market or build factories in the US. Originally, it was extremely difficult for Chinese car companies to export to the United States. In addition to political interference, the United States also has a very strict regulatory system, and Chinese car companies are frequently restricted. Since 2005, six Chinese brands have tried and failed.

An auto industry analyst believes that the promulgation of the “Inflation Reduction Act” in the United States will essentially cause limited losses to Chinese car companies, because Chinese car companies have not yet invested in large-scale factories in the United States, and their market share in the United States is almost zero. . Since there is no business at all, the worst result is that it will not be able to enter the US market.

”At present, the biggest loss may be the export of power batteries, but Chinese power battery companies can rely on the European market to make up for it, and the increasing economies of scale can also bring cost advantages to Chinese battery companies.” The above-mentioned person said.

■ Can the United States get back the “lost four years”?

Since Trump took office, American new energy vehicles have experienced a “lost four years”, almost stagnating at the national policy level, and have been left far behind by China and Europe.

For the whole year of 2020, the sales of electric vehicles in the United States are less than 350,000, while the numbers in China and Europe are 1.24 million and 1.36 million, respectively.

It is not easy for Biden to increase consumer demand by increasing subsidies, because the restrictions set by the United States are too complicated, making it difficult for car companies and consumers to get real money.

Previously, two stimulus bills proposed by Biden have also suffered setbacks. When Biden first came to power, he threw out two “king bombs” one after another: one was to give the electric vehicle industry a $174 billion stimulus policy to subsidize consumption and build charging piles, etc.; the other was to restore the Trump administration. The new energy vehicle purchase subsidy was cancelled during the period, and the upper limit of the bicycle subsidy amount was adjusted to 12,500 US dollars.

Different from other countries, the choice of oil or new energy in the United States is by no means a matter of route in the industrial field, but a weather vane related to politics.

For example, there is a contradiction in the fact that the U.S. oil industry has many implicit subsidy policies, the most typical of which is the low tax rate on gasoline. A domestic research institution has investigated the ratio of gasoline tax to the final retail price, and found that the United States is 11%, while China is 30%, Japan is 39%, and Germany is as high as 57%.

Therefore, the 174 billion subsidy has been severely shrunk under the repeated obstruction of the Republican Party, and the 12,500 subsidy has also set a threshold: $4,500 is only for “unionized” car companies – GM, Ford and Stellantis, Tesla and others Car companies stopped at the door.

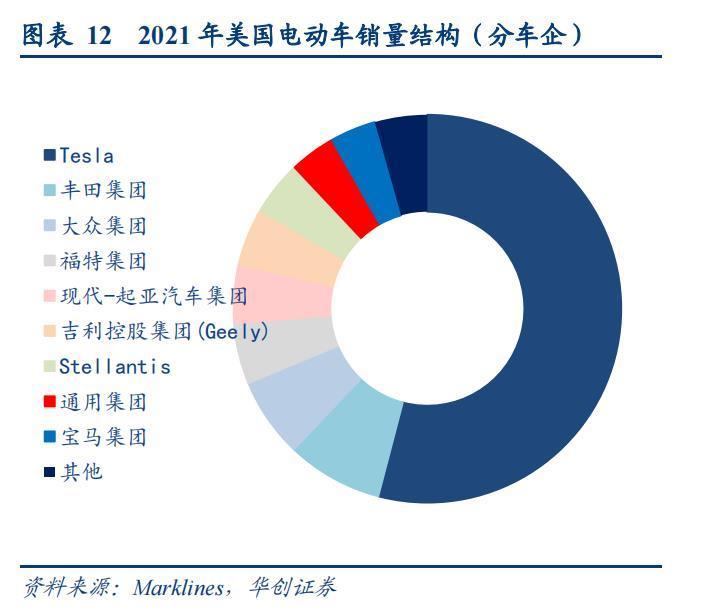

In fact, in addition to Tesla, which has been occupying about 60%-80% of the U.S. electric vehicle market, the three major U.S. domestic auto companies have a heavy burden, lag in transformation, and lack of explosive products that can be beaten. The performance has always been more hip.

According to ICCT statistics, there will be 59 new energy models on sale in the U.S. market in 2020, while China and Europe supply 300 and 180 models respectively during the same period.

In terms of sales data, although the sales of electric vehicles in the United States more than doubled to 630,000 in 2021, sales in China almost tripled to 3.3 million, accounting for about half of the global total; Sales rose 65% to 2.3 million vehicles.

In the first half of this year, in the context of Biden’s call for soaring oil prices, the sales of new energy vehicles in the United States only increased by 52%. %.

According to industry analysts, with the accelerated entry of established car companies such as GM, Ford, Toyota, and Volkswagen, as well as new electric forces such as Rivian, it is expected that in 2022, the number of electric vehicle models in the United States will exceed 100, and it is expected to enter a state of competition among a hundred schools of thought. F150-Lighting, R1T, Cybertruck, etc. will fill the gap in the pure electric pickup market, and Lyric, Mustang Mach-E, Wrangler and other models are also expected to further accelerate the penetration of the US SUV market.

Right now, the U.S. is clearly one position behind when it comes to electric vehicles. At present, the penetration rate of the entire new energy vehicle market in the United States is still at a low level of 6.59%, while the penetration rate of new energy vehicles in China has reached 22%.

As Li Qian said, “China’s electric vehicle industry has been developing in constant struggle for many years. The current state is that the United States relies on support, and China relies on involution and iteration. It is clear at a glance who is the trend. Companies that can survive the competition will probably have no rivals in the international market.”

However, how to maintain the first-mover advantage of electric vehicles is the focus of our future consideration. After all, the track for new energy vehicles is still very long, and in the field of intelligence, our chips are still stuck.

Post time: Sep-22-2022