At the end of June 2022, the national motor vehicle ownership reached 406 million, including 310 million automobiles and 10.01 million new energy vehicles. With the arrival of tens of millions of new energy vehicles, the problem that restricts the development of new energy vehicles in China is infrastructure. Therefore, I want to sort out the infrastructure data regularly (bimonthly) in the future.

● Number of charging piles

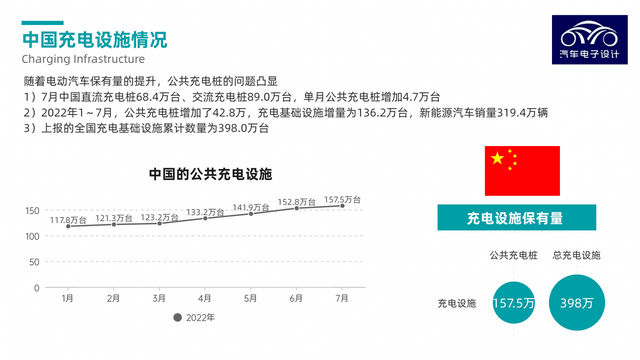

In July, there were 684,000 DC charging piles and 890,000 AC charging piles in China. The number of public charging piles increased by 47,000 in a single month. The cumulative number of reported charging infrastructure nationwide was 3.98 million.

▲Figure 1. The situation of charging facilities in China

●Charging pile distribution

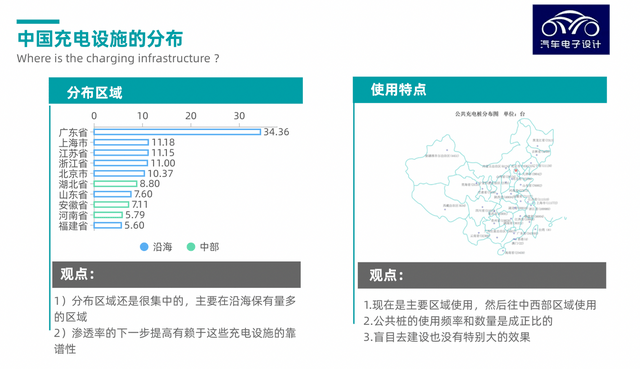

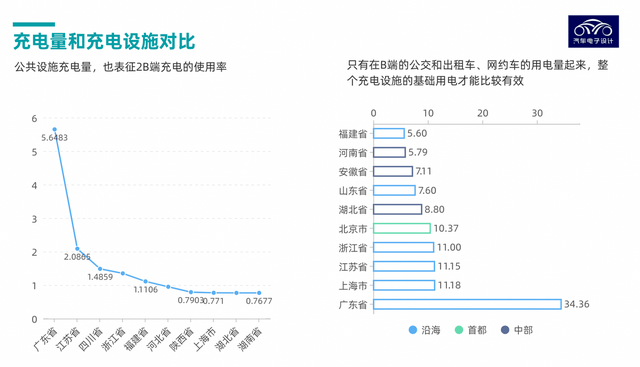

71.7% of the charging piles in the country are distributed in 10 regions including Guangdong, Shanghai, Jiangsu, Zhejiang, Beijing, Hubei, Shandong, Anhui, Henan, Fujian, etc. The charging capacity is correspondingly concentrated in these regions. At present, the power consumption of public charging mainly focuses on For buses and passenger cars, the total charging capacity nationwide in July was about 2.19 billion kWh, which is equivalent to 219kWh of charging per vehicle per month, or about 7kWh per day.

▲Figure 2. Distribution of public charging facilities in China

●Charging operation company

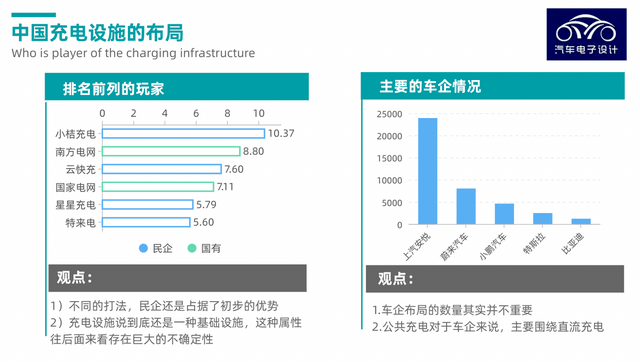

Among the charging pile operating companies in July, 295,000 units were operated by Tedian, 293,000 units were operated by Xingxing, and 196,000 units were operated by State Grid—mainly these three companies. Among them, Xingxing also operated about 72,200 private charging piles. But the most important thing is the DC charging pile.

▲Figure 3. Overview of major corporate charging facilities

Part 1

DC pile laying and power exchange infrastructure

Compared with June, the number of public charging piles increased by 47,000 units in July, a year-on-year increase of 65.7%. As of the end of July 2022, there are currently 1.575 million public charging piles, including 684,000 DC charging piles and 890,000 AC charging piles. In the layout of charging piles, the importance of DC piles is the greatest; at the same time, as the power of DC piles increases, a new wave of investment efficiency will replace the previous 60-100kW with high power, and the relationship between charging power and electrical load also needs to be considered , which may involve a new wave of energy storage investment.

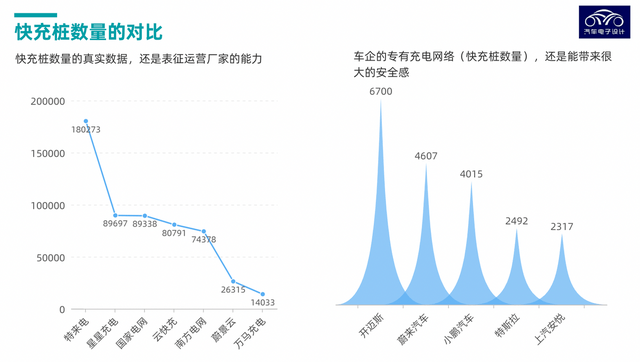

Among the DC charging piles, the overall effect of the 180,000 pieces of special calls is still very good, followed by 89,700 pieces of Xingxing charging, and 89,300 pieces of State Grid. Among auto companies, Volkswagen has built a network of 6,700 fast-charging piles, followed by NIO 4607 and Xpeng 4015. Tesla got off to a good start and has now been fully overtaken. There are only 2492 roots.

▲Figure 4. The situation of the main DC charging piles

In fact, the charging capacity of electric vehicles is also achieved through DC fast charging piles. The charging capacity of the country is mainly concentrated in Guangdong, Jiangsu, Sichuan, Zhejiang, Fujian, Hebei, Shaanxi, Shanghai, Hubei, Hunan and other provinces. The flow is dominated by buses and passenger cars, and other types of vehicles such as sanitation logistics vehicles and taxis account for a small proportion. In July 2022, the national total charging capacity was about 2.19 billion kWh, a year-on-year increase of 125.2% and a month-on-month increase of 13.7%.

▲Figure 5. Comparison of charging capacity and number of charging facilities

● Operational efficiency of charging operators

To see the operational efficiency, you can compare the amount of charging and the number of charging piles.

As of July 2022, the top 15 operators of charging operation enterprises in the country accounted for 92.5% of the total: 295,000 units operated by special calls, 293,000 units operated by Xingxing Charge, 196,000 units operated by State Grid, and 196,000 units operated by Cloud Quick Charge Taiwan and China Southern Power Grid operate 95,000 units, and Xiaoju Charging operates 80,000 units.

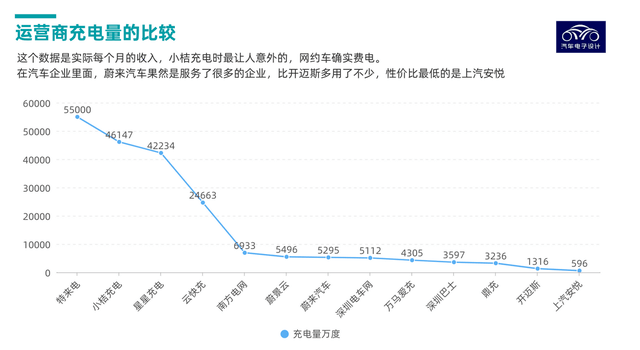

The charging data of each company represents the actual monthly income (Figure 6). Among them, Xiaoju charging is the most surprising, and the online car-hailing does cost electricity. Among the auto companies, NIO has indeed served a lot of companies. It uses a lot more than Kaimeisi. The lowest cost performance is SAIC Anyue.

▲Figure 6. Comparison of charging capacity

From the current point of view, from January to July this year, the increase in charging infrastructure was 1.362 million units, the increase in public charging piles increased by 199.2% year-on-year, and the increase in private charging piles built with vehicles continued to increase, up 390.1% year-on-year. The growth of the entire private charging pile is still very gratifying. The increment of charging infrastructure is 1.362 million units, and the sales volume of new energy vehicles is 3.194 million units. From this year’s point of view, the incremental ratio of pile-to-vehicle vehicles is 1:2.3.

Part 2

Battery swap facility

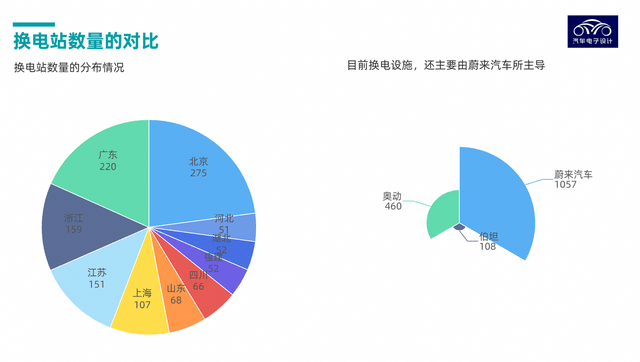

Compared with the overall variety of charging facilities, there are currently 1600+ battery swap stations in the country, of which NIO accounts for 1000+ and Aodong is close to 500. From the perspective of regional distribution, mainly in Beijing (275) , Guangdong (220) and Zhejiang (159) , Jiangsu (151) and Shanghai (107) .

It still takes time to prove that the overall solution is valuable for car companies.

▲Figure 7. The number of swap stations in China

Summary: This wave of new energy vehicle ownership will encounter many problems. One of us is to face the new car market with 20 million+, and there are 400 million ownership.

Post time: Aug-17-2022